價格:免費

檔案大小:43.5 MB

版本需求:需要 iOS 9.0 或以上版本。與 iPhone、iPad 及 iPod touch 相容。

支援語言:英語

Do you really want to pass CPA REG exam and/or expand your knowledge & expertise effortlessly?

This best seller mobile app helps you archive your goal easily by the following unique features:

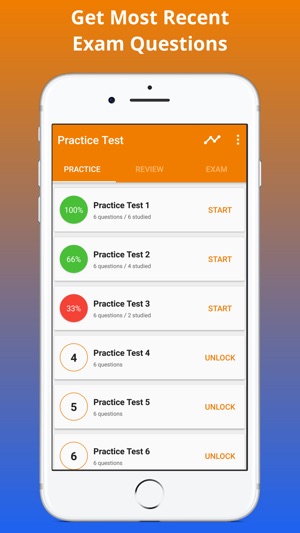

- Break learning materials into small sets of practice questions & terms

- Master each set effortlessly by many ways: flashcard, matching game, true/false, multiple choice

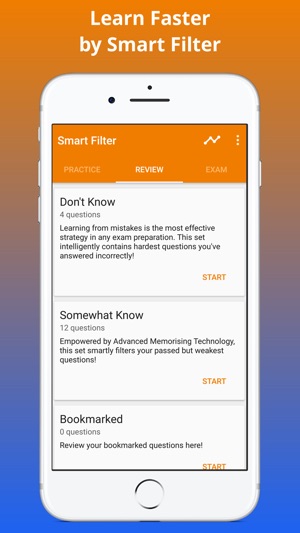

- Detect & separate automatically the most difficult questions

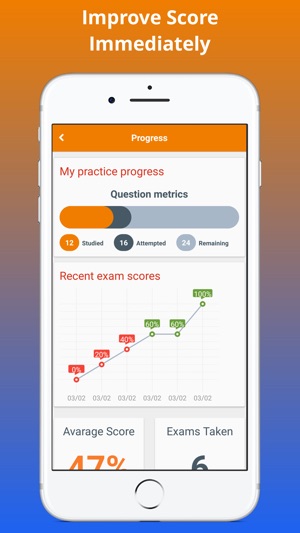

- Track your learning process on every set and exam taken

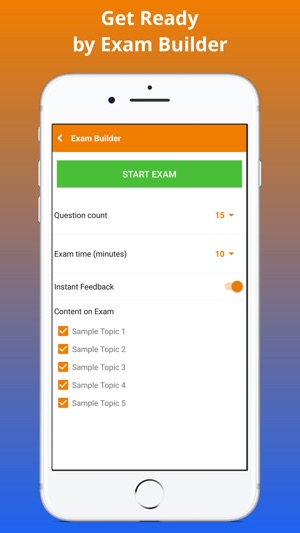

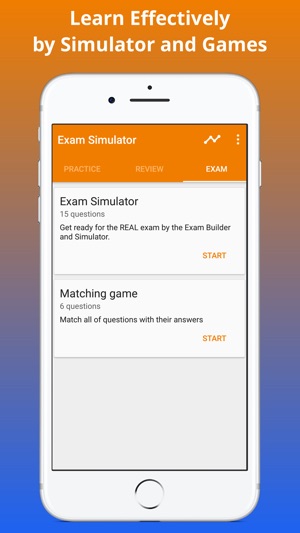

- Ready for the Exam by Exam Simulator

Premium Features:

+) Lifetime access to all Practice Questions & Terms prepared by EXPERTS for the most current exam.

+) Unlimited access to the EXAM BUILDER & SIMULATOR.

+) Automatically FILTER your most difficult questions.

+) PROGRESS TRACKING for every question & exam taken

+) Lifetime support & updates

Free version:

+) Hundreds of practice questions & terms

+) 5 Free Exam Builder

+) Free Matching Game

+) Filter hardest and weakest questions

The Uniform Certified Public Accountant Examination is the examination administered to people who wish to become U.S. Certified Public Accountants. The CPA Exam is used by the regulatory bodies of all fifty states plus the District of Columbia, Guam, Puerto Rico, the U.S. Virgin Islands and the Northern Mariana Islands.

In order to become a CPA in the United States, the candidate must sit for and pass the Uniform Certified Public Accountant Examination (Uniform CPA Exam), which is set by the American Institute of Certified Public Accountants (AICPA) and administered by the National Association of State Boards of Accountancy (NASBA). The CPA designation was first established in law in New York State on April 17, 1896.

The exam has been reduced in time to a fourteen-hour exam, and the sections have been reorganized as follows:

Auditing and Attestation (4.0 hours): (AUD) – This section covers knowledge of planning the engagement, internal controls, obtaining and documenting information, reviewing engagements and evaluating information and preparing communications.

Financial Accounting and Reporting (4.0 hours): (FAR) – This section covers knowledge of concepts and standards for financial statements, typical items in financial statements, specific types of transactions and events, accounting and reporting for governmental agencies, and accounting and reporting for non-governmental and not-for-profit organizations.

Regulation (3.0 hours): (REG) – This section covers knowledge of ethics and professional responsibility, business law, Federal tax procedures and accounting issues, Federal taxation of property transactions, Federal taxation – individuals, and Federal taxation – entities.

Business Environment and Concepts (3.0 hours): (BEC) – This section covers knowledge of business structures, economic concepts, financial management, information technology, and planning and measurement.

Regulation topic cover

15-19% ethical and legal responsibilities

17-21% business law

11-15% federal tax process

12-16% gain and loss taxation

13-19% individual tax

18-24% taxation of entities

Disclaimer:

This application is just an excellent tool for self-study and exam preparation. It's not affiliated with or endorsed by any testing organization, certificate, test name or trademark.

支援平台:iPhone, iPad